Gst on by-products of milling of Dal/Pulses such as Chilka,Khanda and Churi.

- Aditya Singhania

- Aug 8, 2022

- 2 min read

Representations have been received seeking clarification regarding the applicable GST rate on by-products of milling of Dal/ Pulses such as Chilka, Khanda and Churi.

The by-products of milling of pulses/ dal such as Chilka, Khanda and Churi are appropriately classifiable under heading 2302 that consists of goods having description as bran, sharps and other residues, whether or not in the form of pellets, derived from the sifting, milling or other working of cereals or of leguminous plants.

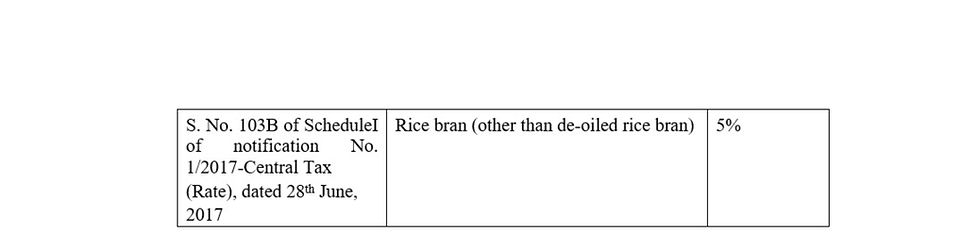

The applicable GST rate on goods falling under heading 2302 is detailed in the Table below:

The dispute in applicable GST rate revolves around the central argument as to whether the above-mentioned by-products are meant for direct consumption as cattle feed and therefore attract exemption under S. No. 102 of notification No. 2/2017-Central Tax (Rate) dated 28th June, 2017 or are otherwise not meant for direct consumption and thus covered under S. No. 103A of notification No. 1/2017- Central Tax (Rate) dated 28th June, 2017 attracting a GST rate of 5%.

While milling of pulses/ dal, a wide range of by-products such as chilka, khanda, churi, among others, are obtained which are preferred as cattle feed by dairy industry for better palatability and higher nutritive value. The mentioned by-products are required to go through varying degrees of processing in order to customize the color, size, aroma, nutrition, purity, etc., of the cattle feed so produced, depending upon the dietary and nutritional requirement of the cattle and the budget availability of the customer(s). Further, as per the Indian Standards 2052:2009 -Compounded Feeds for Cattle — Specification, issued by the Bureau of Indian Standards, Ministry of Consumer Affairs, Food & Public Distribution, Government of India, grain by-products have been categorized as one of the ingredients of the compounded cattle feed.

The GST Council examined the issue and recommended that a clarification be issued in this regard. It also recommended that in view of the prevailing multiple interpretations and genuine doubts regarding the applicability of GST, the issue for past periods may be regularized on as is basis.

Accordingly, it is hereby clarified that the subject goods which inter alia is used as cattle feed ingredient are appropriately classifiable under heading 2302 and attract GST at the rate of 5% vide S. No. 103A of Schedule-I of notification no. 1/2017-Central Tax (Rate), dated the 28th June, 2017 and that for the past, the matter would be regularized on as is basis as mentioned in para 8.6.

Comments